- #CHECKMARK PAYROLL 2019 PDF#

- #CHECKMARK PAYROLL 2019 SOFTWARE#

- #CHECKMARK PAYROLL 2019 PROFESSIONAL#

Provide America's taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.Ĭomments and suggestions.

After each question is the location in this publication where you will find the related discussion. Table A provides a list of questions you need to answer to help you meet your federal tax obligations.

For an explanation of "material participation," see the instructions for Schedule C, line G. Making this election will allow you to avoid the complexity of Form 1065 but still give each spouse credit for social security earnings on which retirement benefits are based. If you and your spouse each materially participate as the only members of a jointly owned and operated business, and you file a joint return for the tax year, you can make a joint election to be treated as a qualified joint venture instead of a partnership for the tax year. 555 for more information about community property laws.Įxception-Qualified joint venture. A change in your reporting position will be treated as a conversion of the entity. States with community property laws include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. possession, you can treat the business either as a sole proprietorship or a partnership. If you and your spouse wholly own an unincorporated business as community property under the community property laws of a state, foreign country, or U.S. 541, Partnerships.Įxception-Community income. If you and your spouse jointly own and operate an unincorporated business and share in the profits and losses, you are partners in a partnership, whether or not you have a formal partnership agreement. For more information on determining whether you are an employee or independent contractor, see Pub. The earnings of a person who is working as an independent contractor are subject to self-employment tax. The general rule is that an individual is an independent contractor if the person paying for the work has the right to control or to direct only the result of the work and not how it will be done. However, whether they are independent contractors or employees depends on the facts in each case. People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

You are also a sole proprietor for income tax purposes if you are an individual and the sole member of a domestic LLC unless you elect to have the LLC treated as a corporation. A sole proprietor is someone who owns an unincorporated business by themselves. For example, if the single-member LLC is not engaged in farming and the owner is an individual, they may use Schedule C. Generally, for income tax purposes, a single-member LLC is disregarded as an entity separate from its owner and reports its income and deductions on its owner's federal income tax return. An LLC is an entity formed under state law by filing articles of organization. You do need to make ongoing efforts to further the interests of your business. You do not need to actually make a profit to be in a trade or business as long as you have a profit motive. The facts and circumstances of each case determine whether or not an activity is a trade or business. A trade or business is generally an activity carried on to make a profit.

#CHECKMARK PAYROLL 2019 SOFTWARE#

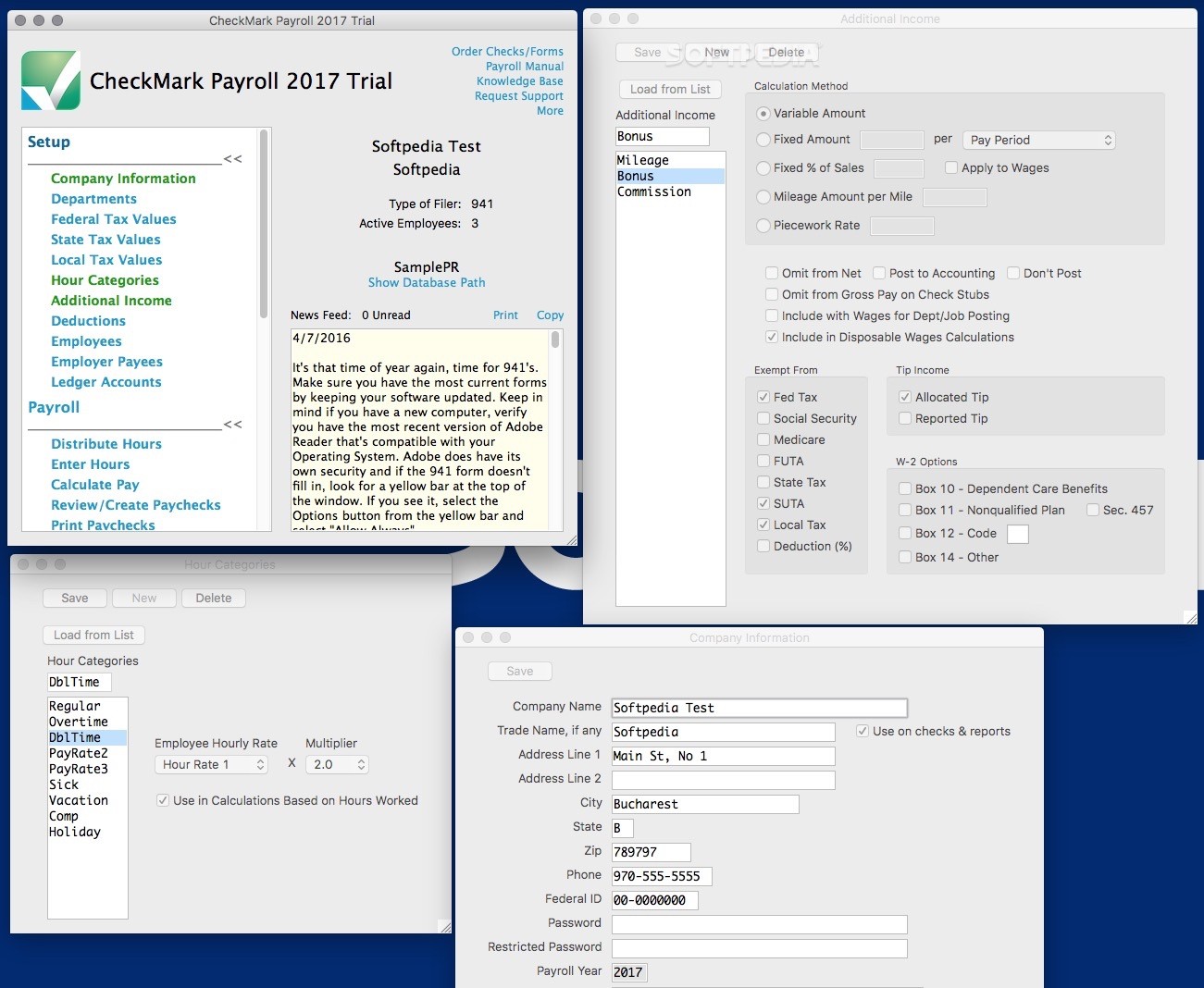

The solution creates ACH-formatted files for direct deposit via a bank or cloud-based deposit service for all employer and employee payments.Ĭompatible with Mac and Windows, CheckMark Payroll Software can be used on a standalone basis, or it can be integrated with other accounting solutions like QuickBooks and CheckMark MultiLedger Integrated Accounting Software.Trade or business. It handles tax-sheltered deductions like 401 (k) and holds federal and state withholding tables. They can also print or e-file W-2s and W-3s to SSA and most states. They can customize income and deductions, and pay their employees by ACH direct deposit or print checks straight out of the program.

#CHECKMARK PAYROLL 2019 PDF#

It imports hours from a time clock or spreadsheet, tracks accrued sick and vacation time, emails PDF paystubs, and prints forms like 941, 940, 943, and 944.ĬheckMark Payroll Software helps users run payroll, print checks, and pay employer taxes in a matter of minutes.

#CHECKMARK PAYROLL 2019 PROFESSIONAL#

CheckMark Payroll is a desktop payroll software for do-it-yourself payrolls, small businesses, accountants, and professional payroll services.

0 kommentar(er)

0 kommentar(er)